Are Austin’s Property Taxes Fair and Equitable?

That Depends on Who You Ask

Investigative Report by Greg M. Schwartz

It’s property tax protest season in Austin, where more than 70,000 property owners have filed protests with the Travis County Appraisal District (TCAD) in an effort to lower their property valuations. The outcome of the protests will directly impact the amount of property taxes due. Residential property owners comprise the vast majority of the formal protests.

The flip side to the equation reveals increasing controversy over whether commercial properties are being undervalued and unfairly shifting too much of the property tax burden onto homeowners.

The folks at ChangeAustin.org, a group of local activists and businesses, cite a 2006 study from the Texas Association of Appraisal Districts (TAAD) that indicated commercial properties in Texas are undervalued by a whopping 40 percent.

ChangeAustin.org’s Brian Rodgers, who has been involved with the local real estate business since 1983, last year called for an investigation from the Austin City Council and Travis County Commissioners Court to challenge the appraised values. But after a year of activism on the matter, he’s come to a different conclusion.

“Obtaining accurate appraisals is a strictly local problem between the appraisal district, the appraisal board, and the taxing jurisdictions they serve. No amount of complaining to the state comptroller or pushing for an investigation will yield any result other than what we already know: the system is broken and any solutions must be found at the local level. The state offers no help. We are on our own,” Rodgers says.

Rodgers believes that single-family homes have taken the brunt of real estate taxes in the past decade while “fat cats” get off due to discrepancies in the valuation of commercial properties.

A key issue is that Texas is one of only a handful of states in the country that does not have a law requiring disclosure of property sales prices. Patrick Brown, chief appraiser of the Travis Central Appraisal District, says he believes Texas is one of eight states that do not have disclosure laws.

“This isn’t a (property sales) disclosure state; we understand that. But you’re not doing your job if you’re not turning over every stone,” Rodgers said in a recent interview. He expressed doubt about some of the appraisals done by the TCAD.

Millions of dollars that could help mitigate civic budget crunches in Austin and across the state are at stake. On July 29 the Austin American-Statesman reported that the City of Austin estimates Fiscal Year 2010 General Fund Revenue will come to $650.2 million. The largest component of the fund, 38.1 percent, is an estimated $247.6 million from property taxes. This includes a projected 3.8 percent dip in assessed property valuation, smaller than the 5 percent dip originally projected.

Still, Rodgers and other activists wonder if property tax revenue is as high as it should be. Rodgers and ChangeAustin.org have been lobbying for a sales disclosure law to address what they see as undervaluation of commercial property. Others closely involved with the situation believe the figures from the 2006 TAAD study are way off.

“I’d say that’s a little extreme; in fact I’d say it’s a lot extreme,” TCAD Chief Appraiser Patrick Brown said of the alleged 40 percent figure, in a recent interview with The Austin Bulldog. “I think we do a lot better than that in Travis and Williamson Counties.”

TAAD has not responded to numerous telephone messages and e-mails requesting an interview about how the 2006 study was conducted and how TAAD arrived at its conclusions.

Brown admits it’s tricky to evaluate commercial properties, noting that data sources available to TCAD, such as closing statements, fee appraisals, and responses to sales inquiry letters, only cover about 20 percent of the appraisals TCAD needs to make. TCAD has to go out and appraise the rest. Brown says he supports a sales disclosure law.

“Most of the battle is trying to convince the Legislature,” Brown says. He says he and appraisers from five or six other districts have spent time lobbying the legislature for a disclosure law, but with no success yet. But Brian Rodgers says he attended the House Committee on Business and Industry’s hearing on a sales disclosure bill last year (HB 2257), brought forward by State Rep. Helen Giddings (D-Dallas), and he didn’t see Brown or any other district appraisers there.

“That’s right, they did not show up,” Giddings says of district appraisers. “I really think it makes more of a difference when people actually testify…to help members of the committee to get a better understanding.”

Brown says he was unaware that such a hearing took place and that he plans to give Giddings a call. Her bill failed to make it out of committee, despite a report she submitted from the state comptroller for public accounts, which indicated the state was losing millions of dollars in potential tax revenue. The Fiscal Note on HB 2257 showed that a sales disclosure law would generate an estimated two-year net impact to general revenue related funds of more than $7.5 million for FY 2011, a small amount because of late implementation. For Fiscal Years 2012 through 2014, the revenue increase would ramp up quickly from $32.7 million in 2012 to $60.5 million in 2014.

With the statutes as written, the money would all be directed to the Foundation School Fund, the state revenue stream that funds public education. Such an influx of funds would be particularly notable due to increasing concern about the lack of sufficient funding for education in Texas.

Giddings says she isn’t sure if she will try to bring the bill up again in the 2011 legislative session. “We just need to vet this and see if there are people who believe that this is an idea whose time has come,” says Giddings.

State Rep. Michael Villarreal (D-San Antonio) and State Sen. Jeff Wentworth (R-San Antonio), a Realtor, have also tried in vain to advance similar bills in the last two legislative sessions.

Both Rep. Giddings and TCAD’s Brown cited the opposition of the commercial real estate lobby, particularly the Texas Association of Realtors and the Texas Apartment Association.

“We are opposed to it (sales disclosure) for a variety of reasons… Our dedication is to fix a broken appraisal system,” says Mark Lehman, vice president of governmental affairs for the Texas Association of Realtors. “Property owners are being victimized… Our dedication is to fix that process first.”

Lehman says chief appraisers are not using all the tools available to them and rely too heavily on sales prices. He pointed to a position paper from his organization saying, “The inaccuracies in appraisals generated by the appraisal district are not because there is a lack of data,” but due to inaccuracies caused by mass-appraisal methods. The paper acknowledges that the appraisal districts “must use such techniques to accomplish their tasks economically,” but criticizes the process as less accurate, “especially to properties that are unique, such as commercial properties or upper-end properties.”

He also cited an incident from four to five years ago where a woman in Austin allegedly offered $25,000 above the market price on a home in a subdivision to get the one next to her mother’s house. Lehman says the value of every home in the subdivision was subsequently raised by $25,000, although he has been unable to track down the witness he says could testify to this.

TCAD’s Brown says he’s not heard of such an incident and that the appraisal district values properties based on all sales in a neighborhood, not a single transaction.

Lehman says, “We’d like to see more confidence in the overall appraisal process before we see mandatory disclosure… Our testimony has always been that we’re against it until the entire appraisal process is reformed.” He says his organization supported HB 8 from State Rep. John Otto (R-Dayton), a bill passed last year that enables the state comptroller to conduct a methods-and-procedures audit on state appraisal districts, instead of auditing only the appraisal numbers.

“We had one chief appraiser say their job was to generate revenue for their tax entities. That’s not their job; their job is to appraise accurately,” says Lehman, citing this as evidence that consumers are not being treated fairly. “We feel like we’re doing this on behalf of consumers… The sales price issue is a distraction from larger issues… Sales price disclosure is not going to fix a broken system.”

Rep. Otto’s views on the matter are similar to those of Lehman and the Texas Association of Realtors.

“I’m opposed (to a sales disclosure law) because no one can assure me it’s going to get properly used… There was no oversight as to whether all 253 appraisal districts were doing their job the same way, or the right way,” says Otto, who sits on two House committees: Appropriations and Ways and Means.

TCAD’s Brown notes that Texas has 253 appraisal districts instead of one for each of the state’s 254 counties, because Potter and Randall counties, near Amarillo, share a district.

Otto said that while he was not familiar with the 2006 TAAD study, he is not inclined to think the gap in commercial property valuations is as wide as 40 percent.

“I will agree that single-family residences are probably closer (to proper value) because appraisers probably have better access to, and a better understanding of, what’s happening in the residential market,” Otto says.

Otto believes that implementation of HB 8 will help clean up the appraisal process and bring about needed reform. Half of the state’s appraisal districts will be audited by the state comptroller this year, and the other half next year.

Would he approve of a sales disclosure law if and when the comptroller reports that all of the appraisal districts have come to use uniform procedures?

“I’m more inclined to look at it then, certainly not before,” Otto says.

David Mintz, a consultant who also serves as vice president of government affairs for the Texas Apartment Association, cited similar reasons to those of Lehman and Otto for his organization’s opposition to a sales disclosure law.

“It’s certainly something we’ve been active with in our opposition,” Mintz says. “The last thing we want to see is a situation where the sales price of a neighboring property is being used to set the value of a similar property… You want to make sure all properties are being treated fairly.”

Mintz says that sales price may not be truly indicative of sales value of a property, saying the income a property generates is at least as important, among other factors. He stressed the market approach as a better way to appraise than looking at comparable sales prices.

Brian Rodgers believes that Mintz and Lehman are being disingenuous.

“Lobbyists say the value is based on the income stream, which is true… So comparing sale of one building with another is not apples and apples…but the building should be taxed at what it was sold for,” Rodgers says. “So for them to say that is a misdirection… The lobbyists don’t want to talk about an accurate system.”

Austin real estate developer and broker Perry Lorenz has been involved in the local real estate business since 1978. He too thinks the numbers from the 2006 TAAD study are exaggerated.

“There’s an element of truth (to commercial properties being potentially undervalued)…but it’s not an overwhelming clear travesty,” Lorenz says.

“Should real estate be taxed at value? Yes. But how do we determine that value? Commercial real estate does not have the high value it achieves unless and until somebody has a full-blown plan…in place,” said Lorenz, citing execution of financing, entitlements and full development.

As to the transparency of the commercial real estate market, or lack thereof, Lorenz believes the truth is out there.

“I believe there is transparency. It may not be in the deeds…but it’s available to competent real estate appraisers all over the city,” says Lorenz. He added that he doesn’t mean to suggest that TCAD appraisers are incompetent, but that they are looking at properties “from a different angle.”

He said district appraisers may have a tendency to take a shortsighted view on what a property will be worth at the moment, rather than the longer view needed to project higher values for fully-realized commercial properties.

TCAD’s Brown says, “We value our properties each year based on sales in the marketplace. Those sales occur randomly throughout the year, and are representative of the market as it exists at that point in time. For the most part, the appraisal roll mirrors the marketplace as of the appraisal date, which for each year for us is January 1.”

Brown says that if a property development is incomplete, the district may have to do some projections.

“The data is entered into our building-cost schedules, and based on the size, type, ceiling height, quality, percent complete and number of stories the property is, a value is generated for the improvements based on our building-cost tables,” Brown says.

As to how TCAD knows what will be built, Brown says that the permits or articles usually describe the purpose of the improvements.

“Sometimes the owner’s name is revealing (McDonald’s Corporation), sometimes the owner or contractors tell us what it is, sometimes the subdivision tells us (Lot 1, Target North Subdivision), and about half the time it is far enough along we can tell what it will be,” Brown says.

Doing property appraisals, it turns out, is something like doing detective work. And like police work, one wonders: are appraisers are ever tempted to bend the rules?

Has anyone ever been indicted for attempting to bribe a TCAD property appraiser? Brown says he’s never heard of such a case. A source in the white-collar crime division of the Travis County district attorney’s office says they don’t prosecute many bribery cases and that their division is unaware of any such crimes related to property appraisals.

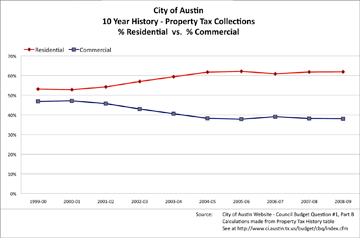

Another trend that Rodgers and ChangeAustin.org are concerned about is how data from the City of Austin shows that the ratio between residential and commercial property taxes in Travis County has changed significantly in the past decade, going from 53 percent residential and 47 percent commercial in 1999, to 62 percent residential and 38 percent commercial in 2009. (Click on the graphic for a larger image.)

“In ten years we didn’t add that many houses… They dropped their scrutiny of commercial and raw land,” says Rodgers, who suspects that the trend is based on depressed commercial appraisals from TCAD.

“In ten years we didn’t add that many houses… They dropped their scrutiny of commercial and raw land,” says Rodgers, who suspects that the trend is based on depressed commercial appraisals from TCAD.

Developer Lorenz, on the other hand, says he is inclined to believe that suburban sprawl is responsible for the shift, noting that Austin is an increasingly popular place to live and a fast growing city.

TCAD’s Brown, who has had the job of chief appraiser since the beginning of 2008, says his predecessor did not place a lot of weight on land valuation. Brown says he decided it was important and ramped up the land division staff from two people to eight. He also says the TCAD has taken a recommendation from ChangeAustin.org and will this year start pulling sales comparables from transactions in which governmental entities buy property.

Another major element of overall property valuations comes from the annual protest process, whereby real estate owners or their agents challenge the county appraisal district on the value of their properties.

TCAD has 70,203 protests scheduled to resolve this summer, in an ongoing daily process. This figure is down from the 94,351 protests in 2009, but up from the 62,165 in 2008. TCAD data shows that more than 64,000 protesters received lower valuations in 2009, up from more than 34,000 decreases in 2008.

As to how the TCAD appraises property, its website states, “The district first collects detailed descriptions of each taxable property in the district. It then classifies properties according to a variety of factors such as size, use and construction type. Using comparable sales, income and/or cost data, a TCAD appraiser applied generally accepted appraisal techniques to derive a value for your property.”

The site further states, “The appraisal district may use three common methods to value property:

Market—What are properties similar to this property selling for?

Cost—How much would it cost to replace the property with one of equal utility?

Income approach—What would an investor pay in anticipation of future income from the property?”

As to how TCAD reviews its work for accuracy, TCAD’s Brown says that several practices are in place.

“We have appraisal managers who review the appraisers’ fieldwork as it is turned in. When the data is entered, it is also reviewed by a data entry clerk, and a reviewer in the support division checks it for accuracy. The appraisal managers are also responsible for field checking a number of parcels for each appraiser each year,” Brown says.

Henry W. Johnson, chairman of the Travis Appraisal Review Board (ARB), says that a 10-member board selects the chief appraiser and the 38 ARB members who meet in three-member panels to listen to and rule on protests.

“We’re like administrative law judges; we have to listen to evidence from both parties,” Johnson says. “It’s almost like petty court where you get judged by your peers.”

Johnson takes a pragmatic view regarding commercial property valuation.

“The best indication of value is what a willing buyer will pay for it and what a willing seller will sell for,” Johnson says.

When asked whether the commercial real estate lobby owns the Texas Legislature, Johnson responded, “That’s a big no comment.”

The appraisal protests are open to the public and recorded for the public record. The protester is given a chance to present the case, followed by an appraiser testifying as to how the property value was determined. The protester is then given a chance for rebuttal. After this, the three-member panel confers and sets the value.

Protest 1: Melissa Goodwin came to represent her mother Cynthia Young and protest her home’s value being raised from $336,000 to $395,000. The house is on Weir Loop in the 78736 zip code, which lies between Highways 71 and 290, west of the “Y” intersection. Goodwin testified that she couldn’t find any other homes in the neighborhood that supported such an increase, saying that properties in the area are not selling (and noting that she lives next door to her mother).

Appraiser Rod Hauserman represented TCAD and cited a median home price in the area of $384,000. He also cited a computerized equity check, in which TCAD’s system scans for properties of similar characteristics and location to create an equity grid of 10 random but similar properties in the neighborhood with a median value of $381,000. The panel decided to use the equity median as the value and ruled a final value $381,000. So Goodwin didn’t get the price lowered as much as she wanted, but did win a decrease of $14,000.

Protest 2: In another case, Peter Van Bavel protested the $505,000 valuation of his home on Bridle Path in the 78703 zip code in West Austin. The primary point of contention was the classification and value of a structure he built behind the house that he calls a workshop but which had been appraised as a living area. Van Bavel said his artist wife uses the building for her art work. He also said the Austin real estate database had shown a trend of declining sales in the neighborhood. He noted that last year’s valuation had been for $541,000 but he felt that it should be valued at $476,000.

After checking on some depreciation values regarding the structure in question, appraiser Rod Hauserman revised the $505,000 value down to $501,000, but noted that statistics showed an average sale value of $518,000 in the area with an equity grid median of $505,000. He said that even though the alleged workshop didn’t have a bathroom or kitchen, it still qualified as a place where someone could stay as a guest and therefore classified as a living quarters rather than a workshop.

Van Bavel suggested that TCAD lacked sales data in the area, saying he thought it was peculiar that TCAD didn’t have more sale records because he had found a lot of them. The chair of the panel informed him that the district’s definition of a neighborhood is different and smaller than an entire zip code, but Van Bavel still asserted that the sales data was under-sampled. Debate ensued about the boundary of a neighborhood code, with Hauserman saying that houses are grouped by class, construction and use, not just geography, and that the population of the code in question was not very large. Van Bavel continued to argue that the 78703 zip code has more data to indicate a declining trend. The panel ultimately ruled for a final value of $501,000.

Protest 3: Adrienne Carter protested the $248,000 value of her home, located on Black Angus Drive in the 78727 zip code that spans north MoPac Expressway in central North Austin. She said her property taxes had gone up every year despite receiving a letter last year from the TCAD offering to lower the valuation. She said she had been too busy with personal issues to come in and take care of it then.

Carter said houses in the neighborhood had not been selling well, largely due to Union Pacific laying an additional rail line through the neighborhood and right behind her house. She cited clear-cutting of trees, excessive noise pollution, debris from the trains, and the danger of a potentially derailed train plunging through her yard. She also noted that real estate agents had been complaining that people were not wanting to buy homes in the neighborhood, and she inquired about receiving an environmental impact exemption, which would discount the property value due to the nuisance of the trains.

Rod Hauserman again represented TCAD and cited two sales this year in the neighborhood with a median price of $237,000, as well as an equity grid median of $244,000. He suggested Carter should receive a flat-value environmental impact exemption and that the land department should be notified to consider an environmental exemption discount for every affected home in the area. The panel conferred and ultimately awarded a $5,000 environmental exemption from the $237,000 median and set the final value at $232,000.

Protest 4: A commercial protest hearing over a rental property saw debate over occupancy rates, equity studies and questions about square footage when calculating the value of individual units. The protester said the property was not being treated fairly, while the appraiser cited a 98 percent occupancy rate as a rarity in the current market. He suggested that the management must be dropping its rents, or that something funny was going on with the occupancy rate. The panel spent a fair amount of time crunching numbers and ultimately issued a ruling that was in favor of the appraiser’s argument.

Henry Johnson says there are far fewer formal protests over commercial hearings as most of them are settled in informal hearings.

Johnson said personal property cases generally do not come to formal hearings since most of them are settled by renditions, where property owners simply report their estimate of personal property value. The owners then meet one-on-one with a TCAD representative. Johnson says the district often accepts the rendition as reported.

Another related issue in the debate over local property taxes is Austin’s increasingly controversial historic preservation program, which drew heavy criticism at the June 10 city council meeting for giving away too many allegedly unwarranted tax breaks over the past few years.

Historic preservationist Rick Harden testified at the meeting and said he was reluctant to criticize a program he has strongly supported, but that the program has changed over the past 30 years and become broken.

“What you have are houses—mansions really—that are being given tax breaks through the historic program that serve no public purpose,” Harden said, according to a video recording of the meeting. “When you give it to someone who doesn’t need it…for a home that’s already been restored…you lower the bar.”

Austin-based appraisal litigation attorney Lorri Michel agreed, telling the council, “The program we have is broken in a serious way.” She said the program is providing “extremely generous tax breaks” to homes that are already operating at their highest use, and therefore don’t need the tax breaks for preservation purposes.

The historic designation exemption can cut a home’s property tax bill in half.

This is another area where Brian Rodgers and ChangeAustin.org have been clamoring for change. Rodgers says the historic preservation program was going okay as long as the gatekeepers were doing a good job of gauging houses that could otherwise get torn down for a redevelopment project, but that this criteria seems to have weakened.

“Now, property taxes have become so oppressive that even the rich are running for cover,” says Rodgers of certain homeowners that his organization feels are undeserving of the tax savings from a historic designation. “Their houses are in no danger of being demolished, so there’s no public good.”

Steve Sadowsky, Austin’s historic preservation officer, says that the qualifications for a historic designation are that a building must be at least 50 years old, maintain its historic appearance, and be significant in two areas in code, generally architectural and historical. He seemed to bristle at the suggestion that unworthy candidates had been earning the distinction.

“This is definitely an anomaly,” Sadowsky said of the increase in applications and approvals over the past couple years. He attributed the increase to entrepreneurs who have been going out to scout up business for which they can earn a fee if they win a historic designation for their client. Sadowsky says he’s seen the same faces popping up throughout the hearing process.

Sadowsky rejected the notion that rich mansion owners have been benefitting from earning tax breaks that they don’t really need.

“It’s not really anybody’s place to say what you do or don’t do with your money…but the tax incentive is something we are looking at,” Sadowsky says. He noted that the recent change to limit historic designation hearings to three a month was simply a caseload issue, because there had been too many meetings occurring.

He added that the city is taking a closer look at comparing how other cities operate historic preservation programs. The city council has also recently agreed to study possibilities such as limiting the city tax break, altering the criteria for historic designation, and further analyzing the economic benefits of preserving older buildings.

ChangeAustin.org has been pushing for reevaluation of the program and claimed a victory earlier this month when the Austin Community College Board of Trustees chose to opt out from participating in giving tax breaks through the historic preservation program.

Attempting to determine whether property taxes in Austin are administered in a fair and equitable manner is a nebulous proposition at best. But it’s instructive to note which parties are on which sides.

Community activists, district appraisers, and large cities like Dallas and San Antonio are on the record in support of a property sales disclosure law.

Commercial real estate lobbyists and what seems like most of the Texas Legislature are opposed.

This Investigative Report was made possible by contributions to The Austin Bulldog, which operates as a 501(c)(3) nonprofit. The Austin Bulldog has many other investigative projects waiting to be funded. You can bring these investigations to life by making a tax-deductible contribution.