More than half of all loan applications received have been rejected

The City of Austin so far has approved 52 Economic Injury Bridge Loans totaling $1,720,400.

That’s nearly 29 percent of the $6 million in Section 108 funds approved by the U.S. Department of Housing and Urban Development for this purpose April 8, 2020.

That’s nearly 29 percent of the $6 million in Section 108 funds approved by the U.S. Department of Housing and Urban Development for this purpose April 8, 2020.

But borrowers haven’t seen a dime of it.

“No loans have closed,” says a statement supplied by David Gray, public information and marketing manager for the City’s Economic Development Department.

“The pace of loan closing falls on the applicant once the applicant receives the loan closing documents. The applicant needs time to review the documents and share with any advisor that they may have worked with.”

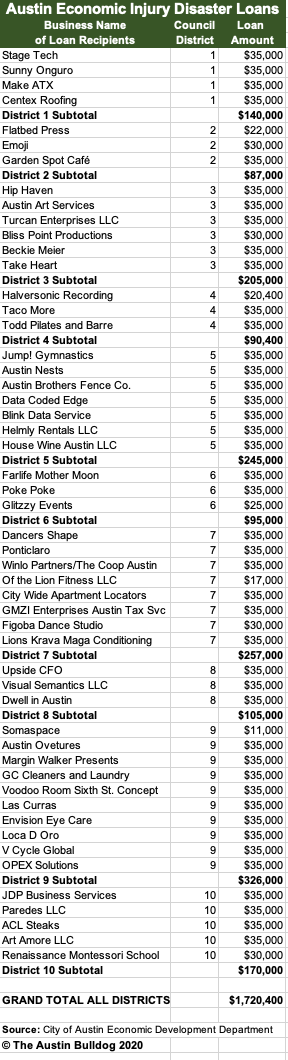

Companies approved for loans

The City’s three-page Dashboard does not provide a list of approved loans. The Austin Bulldog requested an updated list and Gray provided it.

The list shows that all but nine of the 52 loans were approved at the maximum amount of $35,000.

We used information provided by Gray to produce a graphic to show how much money so far has been approved for loans to businesses within each council district. It shows that:

Kathie Tovo’s District 9 businesses got the most loans and the most money: nine loans totaling $326,000.

Leslie Pool’s District 7 businesses netted eight approved loans totaling $257,000.

Ann Kitchen’s District 5 businesses got seven loans totaling $245,000.

Sabino “Pio” Renteria’s District 3 companies got six loans totaling $205,000.

Alison Alter’s District 10 firms got five loan approvals totaling $170,000.

Loans were approved for the other five council districts as well, as shown in the accompanying graphic.

You can see a City of Austin map showing the boundaries of each council district.

The Austin Bulldog called or emailed a half-dozen companies for which Bridge Loans had been approved. Most did not respond. Here’s what two business owners that responded had to say.

Fine art business is being funded

Katherine Brimberry, co-founder, owner and master printer at Flatbed Press, was the first company approved for a Bridge Loan, in the amount of $22,000. (The maximum amount of loans for this program is $35,000.)

The fine art studio of etchings, lithographs, relief prints, and monotypes is also a gallery specializing in prints and other works on paper, according to Brimberry’s LinkedIn page.

In a telephone interview she said she’d been working on getting this loan for a couple of months. Back in March she also applied for a loan from the U.S. Small Business Administration (SBA), a prerequisite to apply for the City’s Bridge Loan.

“I had worked with the city before and reached out about any help they might have. I was told by the Economic Development Office this was going to be available and I applied,” she said.

Brimberry said she got the okay for the loan about two weeks ago.

“I sent the documents to my CPA to look at and got an okay from her. She said it looked okay. I signed it electronically this week,” she said.

“They were taking the signed documents to the offices to ask for a check, yesterday or day before yesterday,” Brimberry said.

She gave city staff high marks for the way the process was handled, especially Javier Zarate, the program manager she worked with.

Was the delay a problem? No. Of course I want it sooner rather than later. I’m delaying paying my creditors as much as I can. I’m being patient about it. I have enough of a cushion to hang on…I’m not paying full rent.”

Nearby businesses in that area of southeast Austin haven’t been so lucky. She said Fit and Fearless Gym was moving things out of its space. That company’s website said the doors were closed indefinitely. “…our landlord has not offered any reprieve and many of our students are not ready to return, understandably.”

Owner-instructors Brandon Phillips and Jessica Phillips wrote, “We have provided a place of community and empowerment in Austin for 19 years so this is not goodbye, but rather see you later.”

Tourism business is not taking City money

Austin Overtures (AO Tours Austin on the website) is a company that depends on tourists who come to Austin and see the sights. Only right now there aren’t many tourists.

Mary Davidson, who co-owns the business with husband Dow Davidson, said they’ve gone from booking some 22 tours a week to about three a week.

“We applied for an SBA loan early on. It was the second week in May before we got the SBA loan. It came exactly the same day as they got approval for the City’s Bridge Loan.”

“We did not accept the Bridge Loan,” which would have had to be repaid with the SBA loan anyway.

Davidson did not want to disclose the amount of the SBA loan.

“We called the SBA back and got funded within 48 hours. We got a lot less than we were hoping to get. We’re going to drag it out as long as we can to make it last as long as possible.”

She said they are continuing to pay employees even though there’s nothing for them to do. “We can’t afford to lose them or we couldn’t start back up again.”

“We’re very grateful that the number of people going to hospitals (because of COVID-19) continues to drop. I hope it stays that way.”

Nevertheless, the tourism business has been hit hard. “Until the attractions open and people come back to Austin, there’s not much to be done,” Davidson said. “It’s really been hard.”

Bridge Loan capacity far exceeds demand

Information supplied by the city indicated 125 applications for Bridge Loans had been received. In addition to the 52 approved, 58 were declined, and 15 applications are still under review.

Upon receipt, applications are sent to underwriting, where they are examined for cash flow and ability to repay the loan.

After underwriting the City’s Loan Committee reviews all applications.

Once approved and closing documents are sent to the applicants, it’s up to the borrowers to follow through and supply documents necessary for release of funding.

The City set aside $6 million for this program. A total of 52 loans have been approved for a total of $1,720,000. Some, like Austin Overtures, will wind up not taking the money because they already got an SBA loan.

So about two-thirds of that $6 million available will not be utilized unless applications increase dramatically. Or the city finds another avenue to help more businesses with it. To use Section 108 funds in another way, the City would have to obtain HUD approval.

Trust indicators:

Ken Martin has been covering local government and politics since 1981. In the last dozen years of his Marine Corps career Ken was a financial accounting officer. See more about Ken on the About page.

Ken Martin has been covering local government and politics since 1981. In the last dozen years of his Marine Corps career Ken was a financial accounting officer. See more about Ken on the About page.

Links to related Bulldog coverage:

City bridge loans approved for 22 of 145 applicants so far, May 18, 2020

City bridge loan program off to a slow start, April 27, 2020