SBA declines to provide information for Travis County and City of Austin

Small businesses across the state of Texas have received federal funding from the U.S. Small Business Administration (SBA) totaling more than $29 billion to help them survive the economic disaster caused by the COVID-19 pandemic.

The funds were disbursed under several different programs, each of which is detailed in this story.

That financial help is a whole lot more important than celebrating National Small Business Week, which the SBA usually observes during the first week of May. Instead the SBA has been hustling to disburse billions of dollars in a variety of programs to help keep small businesses afloat.

A lot more money could have been provided but, as the Washington Post reported last week, nearly 300 publicly traded companies combined received more than $1 billion in stimulus funds meant for small businesses.

The Austin Bulldog sought to pin down how much federal financial aid was provided for small businesses in the City of Austin and Travis County. But the SBA declined to provide that information in response to a request filed under the federal Freedom Of Information Act.

Instead the agency pointed to information published on its website pertaining to national statistics with breakdowns for states and territories. We used that data to construct graphics for this article that show the Top 10 states in several funding categories.

The complete statistics for all states and territories are linked at the end of this article.

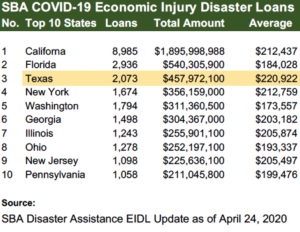

Economic Injury Disaster Loans (EIDL)

The SBA accepted loan applications for up to $2 million from small businesses that were affected by the COVID-19 economic disaster and employ up to 100 workers.

These are not grants. The SBA is a cash-flow lender and applicants must demonstrate ability to repay the loan.

Through April 24, 2020, the SBA had approved a total of 38,984 loans totaling nearly $8 billion. Texas ranked third in garnering slightly less than $458 million, far behind the $1.9 billion that went to California, a state whose population of 39.5 million people outstrips the Lone Star State’s 29 million people.

The EIDL loans made to 2,073 Texas companies averaged almost $221,000.

Paycheck Protection Program

The SBA launched the $349 billion Paycheck Protection Program April 3, 2020. The program provides forgivable loans up to $10 million to small businesses left financially distressed by the COVID-19 pandemic, according to the agency’s press release.

These loans were provided to small businesses without collateral requirements, personal guarantees, SBA fees or tests for having credit elsewhere. “If after eight weeks the businesses show that they used at least 75 percent of the loan for payroll, the loan can be forgiven,” according to an Inc. report.

After that money ran out, an additional $320 billion for the Payroll Protection Program was signed into law April 24.

As of April 16, 2020, the SBA, acting through nearly 5,000 lenders, had approved more than 1.6 million loans intended primarily to pay the salaries of employees.

California ranked No. 1 in getting $33.4 billion while Number 2 Texas netted $28.5 billion. California companies got 112,967 PPP loans that averaged $295,782, while Texas companies got 134,737 loans that averaged $211,402.

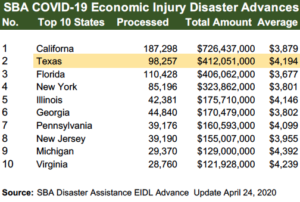

EIDL Advances

Small business owners were eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000 based on $1,000 per employee. The advance was designed to provide economic relief to businesses experiencing a temporary loss of revenue and will not have to be repaid.

Small business owners were eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000 based on $1,000 per employee. The advance was designed to provide economic relief to businesses experiencing a temporary loss of revenue and will not have to be repaid.

Once again California companies netted the most total funding at $726.4 million for 187,298 companies. Texas results show that 98,257 companies received such advances totaling $412 million.

In all there were 1.2 million advances for all states and territories totaling $4.8 billion.

Links to related documents:

SBA Disaster Assistance Update for Economic Injury Disaster Loans (EIDL) COVID-19, April 24, 2020 (2 pages)

SBA Disaster Assistance Update for EIDL Advances COVID-19, April 24, 2020 (2 pages)

SBA Paycheck Protection Program (PPP) Report, approvals through April 16, 2020 (6 pages)

SBA letter responding to The Austin Bulldog’s FOIA request for data about Economic Injury Disaster Loans for small businesses in Austin and Travis County, April 30, 2020 (2 pages)

Related Bulldog coverage:

City bridge loan program off to a slow start, April 27, 2020

Small businesses can apply for city’s bridge loan loans Monday, April 9, 2020

COVID-19 disaster help coming for small businesses, March 26, 2020

Trust indicators:

Ken Martin has been covering local government and politics since 1981. See more on the About page.

Ken Martin has been covering local government and politics since 1981. See more on the About page.

Email [email protected]