With just weeks to go in his term, Mayor Steve Adler is seeking to finalize a sweetheart tax deal for a developer that donated tens of thousands of dollars to his reelection campaign and those of other council members.

The council has scheduled a vote for December 1st to amend the tax status of a 118-acre lakeside area where Endeavor Real Estate is the largest landowner and plans to build as many as six luxury high rises.

The special tax status, known as a Tax Increment Reinvestment Zone (TIRZ), would divert property tax from the general fund toward building infrastructure within the current private property of the zone, particularly inside an 18-acre parcel known as the ‘Statesman PUD,’ which Endeavor is redeveloping.

Plans call for the city to pay for the construction of a commercial plaza in the shadow of the new high rises, as well as park amenities, new roads, and luxury streetscapes of the kind found in private shopping centers like the Domain, which was also an Endeavor development that also benefits from millions of dollars in rebates of sales and property taxes. Though the city would provide the funds, Endeavor wants to manage the construction itself.

Proponents say the public-private collaboration would result in a smart, walkable, transit-friendly development near the center of the city that would provide substantial public benefits, including public access to a lakeside park.

Driving a harder bargain?

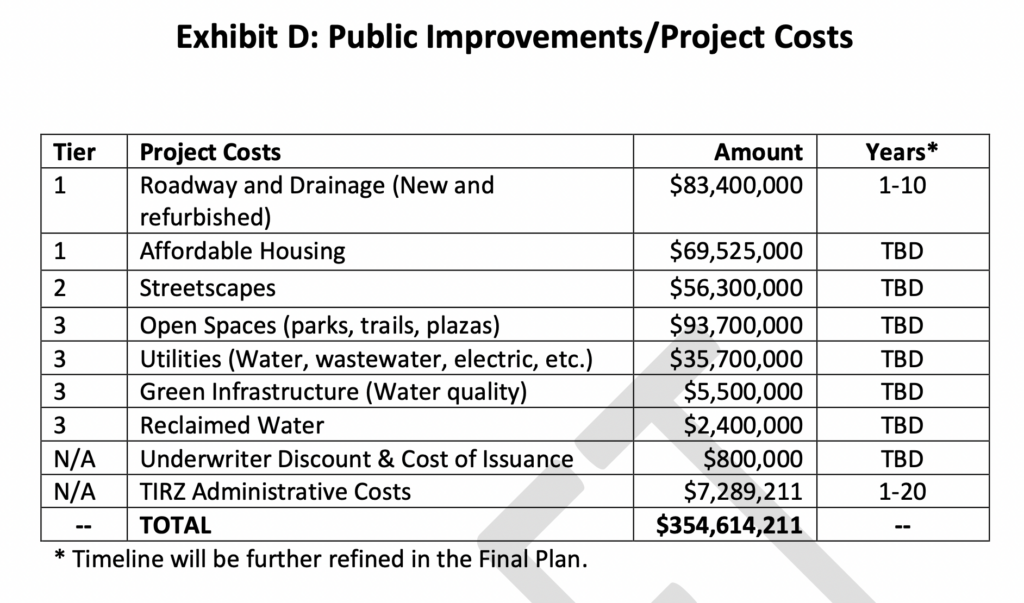

The TIRZ could also fund up to $69.5 million for affordable housing, out of a total $354.6 million project plan, according to an amended plan published as backup to the December 1stagenda. That’s a substantial change from earlier plans for the TIRZ and likely represents an effort to sweeten the deal for the city and sway skeptical council members to get behind the plan.

However, the fiercest critics of the proposed TIRZ are unconvinced by this sweetener. “Don’t be fooled or confused by the constant refrain of ‘affordable housing,’” wrote environmental group Save Our Springs Alliance in a brief policy paper emailed to supporters.

“Most of the taxpayer funds flowing into the SCWF (South Central Waterfront) TIRZ would pay for standard private costs that every other developer must pay for on their own. The affordable housing should be required—not paid for by taxpayers—in exchange for the massive increase in development entitlements from 660,000 square feet to 3.6 million square feet.”

At this stage it’s unclear whether Endeavor itself supports the new TIRZ ordinance. The Bulldog reached out to Endeavor’s representative Richard Suttle to ask his position on the matter but didn’t hear back from him. Suttle previously said that Endeavor would not proceed with its lakeside high rises without TIRZ funding for public infrastructure in the area.

The TIRZ revenue was already projected to be inadequate to fund all the proposed projects in the South Central Waterfront—and that was before factoring in costs for affordable housing, according to Kimberly Olivares, the City’s deputy chief financial officer. She recommended at a council work session July 26th that the council consider reducing the project scope. The December 1st ordinance does the opposite, adding an ambitious funding element for affordable housing.

The amended preliminary project and financing plan indicates that the first $83.4 million in the TIRZ will be for new and refurbished roadways and drainage. Although affordable housing is listed as as “Tier 1” priority, no timetable is given for the affordable housing investment, apart from a notation “TBD” and a footnote indicating that the timetable would be “further refined” later.

Tax subsidies for prime real estate

As previously reported by the Bulldog, a TIRZ is a tax financing mechanism originally intended to encourage development of “blighted” areas. According to state law, the TIRZ area must constitute “a menace to the public health, safety, morals, or welfare,” or an impediment to “the sound growth of the municipality” because of the presence of deteriorating structures, a slum, unsanitary conditions, or certain other criteria.

In its December 2021 ordinance creating the TIRZ, the council cited two such criteria: “faulty lot layout” and “defective or inadequate sidewalk and street layout.” Because of those conditions, the growth of the waterfront district is substantially impaired, the ordinance stated.

The council also made a finding that “development or redevelopment in the Zone would not occur solely through private investment in the reasonably foreseeable future.” That raised eyebrows because the TIRZ is prime real estate where development is almost certainly likely to occur without a TIRZ.

If at first you don’t succeed…

Adler, the principal champion of the idea on council, led the push to create the TIRZ at a special council meeting just before the year-end holidays last year. The TIRZ was the only item on that council agenda, indicating the special treatment given to Endeavor and this issue.

Council Member Kathie Tovo, who represents the area, also strongly backed the idea at that time, though she has since expressed some doubts about it and sought to compel Endeavor to include more affordable housing in its high rises.

At the December 2021 meeting, Adler and Tovo succeeded in winning council approval for the creation of the TIRZ, but they were forced to settle for a zero percent tax increment for the zone—meaning it wouldn’t yet be operational—with the idea that this rate would later be amended.

Discussions to do so stalled in the spring following a public outcry stirred up in large part by Save Our Springs Alliance and its partner, Taxpayers Against Giveaways. But at a work session over the summer staff members revived discussion of the TIRZ as Adler indicated that he still supported the plan and would work to make it happen.

The draft ordinance for the December 1st meeting would increase the TIRZ increment from zero percent to 46 percent. That means that municipal revenue from 46 percent of all appraised property value added in the district since 2021 (the year the TIRZ was created) will be diverted to a special fund.

The special tax arrangement would last until December 31, 2041. It would affect only City of Austin general fund revenues, not those of other taxing entities.

Promises, promises

This wouldn’t be the first time that Adler has promised to leverage a special tax arrangement to provide new social services. From 2016 to 2019, as Adler sought to sell an expansion of the downtown convention center, he repeatedly linked the plan to a hotel-funded boost in dollars for homeless services.

Adler’s plan was to convince the hoteliers to create a Tourism Public Improvement District, an industry-led public corporation that would levy an additional 1 or 2 percent hotel occupancy tax. Such corporations typically use their revenue to advertise conventions and incentivize convention bookings, through a contract with the local visitors’ bureau. But Adler envisioned a carveout of that revenue to fund services at the ARCH homeless shelter, in return for council approving an increase in the hotel occupancy tax to fund the Convention Center expansion.

The quid pro quo featured prominently in the mayor’s “downtown puzzle,” a proposal to shape the downtown, which he unveiled on the council message board December 22, 2016.“Indications are that the Austin hotel industry would participate in providing such a funding stream to deal with the community priority of downtown homelessness if it were part of a package that also included the expansion of the convention center,” he wrote.

But the arrangement didn’t work out quite as planned. Although the hoteliers ended up getting new funding and a green light for the convention center expansion, no new revenue ever came of it for homeless services.

A major reason for that was that the hotel industry quietly moved to undercut Adler’s plans, even as he worked to help them. In the 2019 legislative session, State Representative Four Price (R-Amarillo) passed a bill limiting Tourism Public Improvement Districts to spending money on “advertising, promotion, or business recruitment… directly related to hotels.” Previously, TPIDs could spend money on a variety of purposes, including sanitation, public safety, and affordable housing.

A legislative aide to Price told the Bulldog in 2021 that they made the change at the behest of Scott Joslove, President of the Texas Hotel and Lodging Association. Joslove also testified in favor of the bill, saying it would allow hoteliers to secure new business without the risk of TPID funds being diverted toward “pet projects.”

The incident is an example of how Adler has previously sought to marry progressive policymaking with special deals for private interests—sometimes unsuccessfully. Though the proposed TIRZ is a somewhat different tax arrangement, it represents the same deal-making approach.

‘Tax turkey’

Ahead of the Thanksgiving holiday, Save Our Springs Alliance and an allied advocacy group, Taxpayers Against Giveaways, blasted out emails calling the proposed TIRZ a “tax turkey.”

The former group wrote, “Diverting $300 million of future property tax revenue into a special fund sequestered primarily for the private benefit of wealthy South Central Waterfront property owners translates directly into tax increases and/or lost public services for every other Austin taxpayer.”

“A council vote to transfer $300 million to the SCWF developers means the council believes their needs are more important than their constituents’ needs for parks, libraries, and other services. Council cannot claim they care about taxes or affordability while handing out hundreds of millions in developer welfare.”

Save Our Springs is led by Bill Bunch, an environmental attorney who has also raised environmental objections to the Statesman PUD development. He also serves on the board of Taxpayers Against Giveaways, a nonprofit whose other board members are Holly Reed, Nelson Linder, Fred Lewis, Laura Templeton, James Valadez, and Roger Borgelt.

Trust indicators: Bulldog reporter Daniel Van Oudenaren is a journalist with 13 years experience in local, state, and international reporting.

Related documents:

Draft ordinance amending Tax Increment Reinvestment Zone No. 19, December 1, 2022

Amended TIRZ project and financing plan, December 1, 2022

Ordinance creating Tax Increment Reinvestment Zone No. 19, December 20, 2021

Related Bulldog coverage:

Environmentalists assail plan for lakeside high rises, October 4, 2022

Council revives plan to use ‘blight’ law to subsidize luxury high rises, July 28, 2022

Luxury subsidy deal stalls at council, February 3, 2022

Luxury real estate to get special tax status under ‘blight’ statute, December 21, 2021

Cabo Steve trying to deliver to his real estate constituents on the way out the door. How anyone would ever vote for an eminent domain lawyer for mayor is unbelievable.

Could the Bulldog add an addendum to this article of all the current and pending council members who have received donations from Suttle, Endeavor. et. al?

This city has a playbook called the December surprise. The city passed the second neighborhood plan for those of us south of the river in December 2005. This was for the entire area from the river to Ben White, IH35 to S. Congress. Zoning changes and future land use on each and every parcel of land had to be discussed and voted on after two years of work by neighbors to solidify/steward/protect our quality of life. This was scheduled by staff and Council during the month between Thanksgiving and Christmas when residents have many other things to do.

Where did it get us? We now have a SoHo House private club for international multimillionaires, a Hermes store for the wandering shoppers from abroad and exponentially increasing property taxes. Soon, we will have a “new” Opry House music venue when the old one was a known threat to the quiet enjoyment of our property. And now we must have parking permits to park in front of our own houses.

THANK YOU AUSTIN BULLDOG for pointing out this tax scheme being illegally applied to non blighted property.